Learning Center articles may describe services and financial products not offered by Protective or its subsidiaries. It is not intended as investment advice and does not necessarily represent the opinion of Protective or its subsidiaries. The information presented is for educational purposes and is meant to supplement other information specific to your situation. For more information, consult with an estate planning attorney located in your state, particularly if you move from one state to another.Īll Learning Center articles are general summaries that can be used when considering your financial future at various life stages. Note: This article is to provide general education on estate planning and not as tax or legal advice.

By doing so, you can plan ahead to ensure that more of your legacy goes to those you love. Taxes, whether inheritance or state, must be considered in estate planning.

#Federal inheritance tax professional

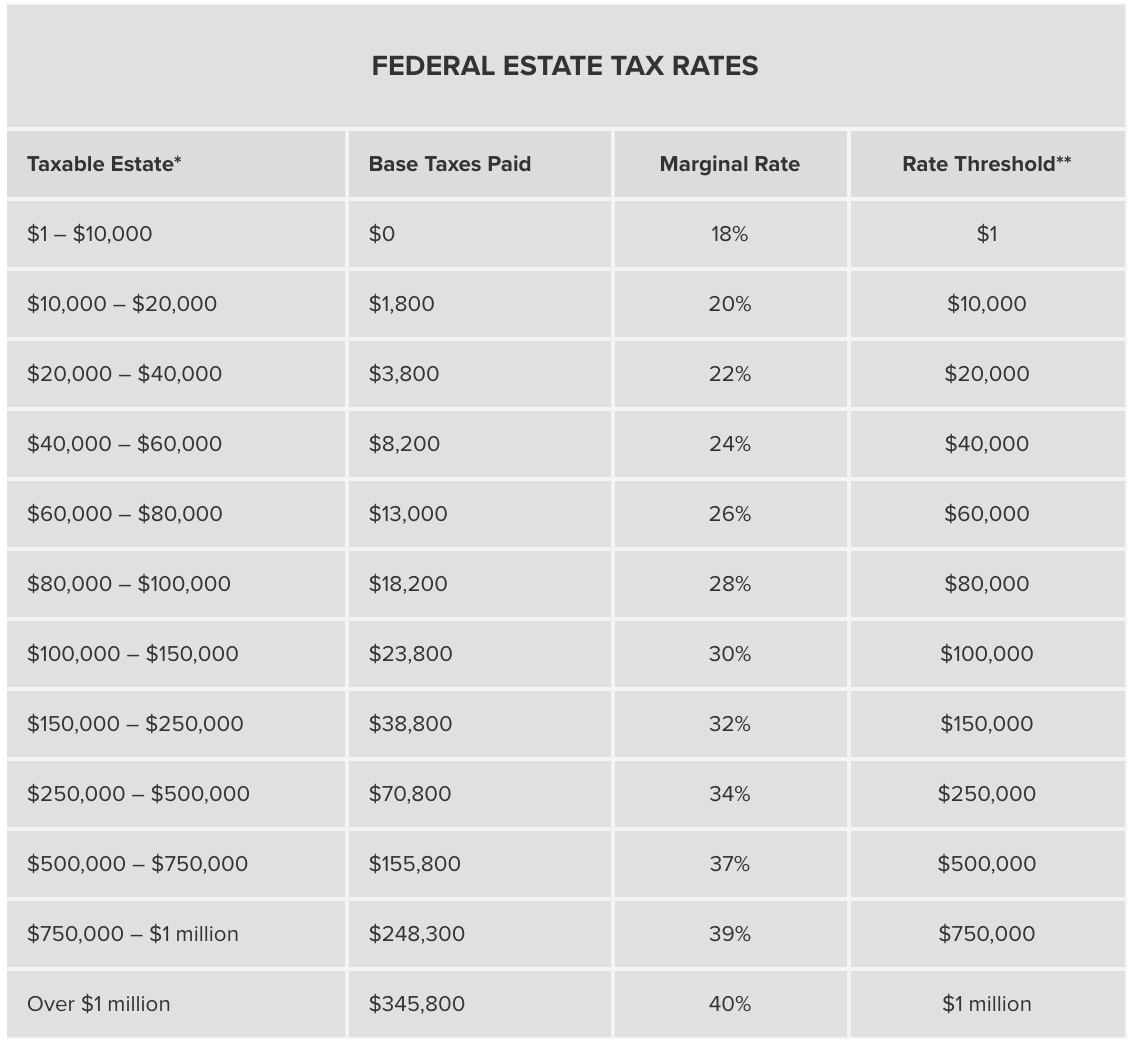

It’s always a good idea to consult a qualified financial professional or tax expert who can help guide you on strategies for reducing taxes as you pass your assets to your loved ones. States may also impose an inheritance tax.Īccording to the AARP, there are 17 states with inheritance or estate taxes.įor estate planning purposes, it's important to note which states are subject to inheritance and estate taxes. This tax is calculated separately for each beneficiary, and as such, each beneficiary is responsible for paying his or her own inheritance taxes. Unlike the federal estate tax (where the estate pays the taxes), inheritance taxes are the responsibility of the beneficiary of the property. This is a state tax in which the beneficiary (the person or persons who receive money or property from the estate of a deceased person), must pay. If you've inherited money or property after a loved one dies, some states impose an inheritance tax. Which states impose an inheritance or estate tax? An estate tax is calculated on the total value of a deceased's assets, and is to be paid before any distribution is made to the beneficiaries. The executor is responsible for filing a single estate tax return and pays the tax out of the estate's funds. Unlike an inheritance tax, estate taxes are charged against the estate regardless of who inherits the deceased's assets. The main difference between inheritance and estate taxes is the person who pays the tax. The IRS provides more information about the federal estate tax and allowable deductions. There is a federal estate tax on estates valued over $12.06 million. For example, if you inherit a loved one’s house and then sell it, the earnings off that house will be taxed at your regular income tax rate.

It’s also important to keep in mind that income earned based on any assets inherited will be taxed by both federal and state governments unless derived form a tax-free source. However, state taxes on inherited assets vary depending on the state. Inherited assets are not classified as income for federal tax purposes. It’s important to understand what portion of your inheritance is subject to federal and/or state taxes so that you can avoid surprises come tax time. When it comes to inheriting money, there are some things you should know.

0 kommentar(er)

0 kommentar(er)